Individuals with a high net worth need to think about the estate they have built in the long term.

The core challenge they face isn't just increasing those assets, but how to protect them.

To do this, they must also face the tricky issues of inheritance and taxes.

Realized together, all of these best practices make what we call "asset protection".

In order to achieve this, we believe that it is necessary to help our clients protect their assets not through a relationship

that ends with a transaction alone, but through a long-term relationship, in line of sight and in step with our clients.

In addition, in order to make the best proposals for our clients, we have a legal office specializing in assets,

management, and inheritance in our group, so that they can rely on us with peace of mind and trust.

This has enabled us to create a one-stop system that no other company can match, capable of resolving all kinds of concerns,

from our unique consulting services for high-net-worth individuals to the provision of specialized knowledge and services.

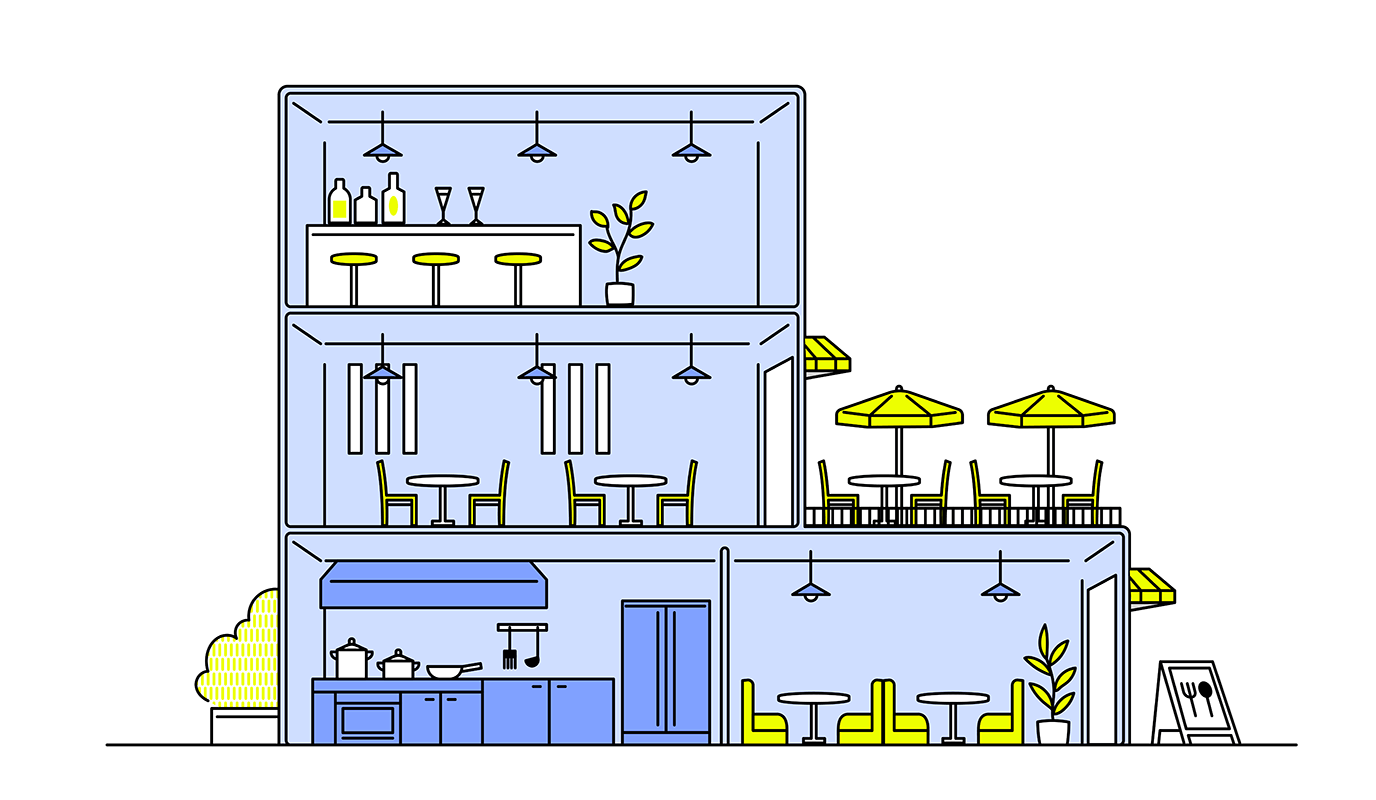

We help our clients maximize the use of real estate as a weapon in their asset portfolios.

We want to be your best real estate partner.